GST Input Credit (ITC) on Corporate Social Responsibility (CSR) Expenditure. An Analysis

In a world that’s continuously evolving, the blend of corporate responsibilities and fiscal policies remains an intriguing area for businesses, policymakers, and the public alike. One such topic at the heart of recent discourse is the interplay between the Goods and Services Tax (GST), Input Tax Credit (ITC), and Corporate Social Responsibilities (CSR).

What are GST, ITC, and CSR? Even though these acronyms sound complicated, they’re relatively simple when broken down.

Goods and Services Tax (GST) is a comprehensive, destination-based tax that subsumes various indirect taxes, levied on every value addition in goods and services. GST seeks to streamline the tax administration, avoid multiple taxation, and bring in more businesses into the tax net, thereby bolstering the country’s economic growth. GST Audit Services can help businesses comply with all statutory requirements related to tax.

Input Tax Credit (ITC), a vital element of GST, refers to the tax that businesses pay on a purchase, which can be used to reduce the tax liability when they make a sale. In essence, ITC means reducing the taxes paid on inputs from taxes to be paid on output. Taking advantage of ITC necessitates guidance from professionals providing GST Consultancy Services.

Corporate Social Responsibility (CSR) signifies a company’s commitment towards the socio-economic welfare of the communities where they operate. CSR activities, in India, are governed by the Companies Act’s statutorily obligated spend as laid down in Section 135. These are essentially specific initiatives that companies undertake, which extend beyond their business, to give back to society.

The debate stirring the industry, however, is whether a company can claim ITC on GST paid for goods and services used in these CSR activities?

This article aims to shed light on this topic in detail, enabling the layman to understand the intricacies of this debate, tracking the legalities, and scanning the effect of the latest amendments on this issue.

For businesses perplexed by this conundrum, don’t hesitate to reach out to GST Litigation Services, who can guide you in the right direction.

GST Input Tax Credit (ITC) and CSR Expenditure: The Ongoing Debate

The question of whether ITC can be claimed by businesses on CSR expenditure under the GST regime has been a contentious issue for quite some time now. This debate gains significance due to the mandatory nature of CSR activities as stipulated in Section 135 of the Companies Act.

Mandatory CSR activities under Section 135 of the Companies Act

Section 135 of the Companies Act mandates that certain companies must spend a specified amount towards CSR activities every financial year. These activities focus on promoting societal and environmental well-being and include initiatives related to education, healthcare, women’s empowerment, environmental sustainability, and more.

Failure to fulfill the CSR obligation can lead to penal consequences for companies. Given the mandatory nature of CSR activities, the ambiguity around claiming ITC on related expenses has been a subject of discussion and deliberation.

Differing Views on Allowing ITC on CSR

Within the realm of GST, there have been two conflicting schools of thought regarding the eligibility of claiming ITC on CSR expenses.

Proponents of allowing CSR expenditure as eligible for ITC argue that it is a necessary expense incurred by the company in compliance with the statutory obligation under the Companies Act. They view CSR as an integral part of business operations and believe that denying ITC on such expenses would be contradictory to the fundamental purpose of GST, which is to allow credit for business-related expenses.

On the other hand, those opposed to allowing ITC on CSR expenses assert that CSR activities are not directly related to the normal course of business operations. They argue that since CSR is a voluntary social obligation, the expenses incurred should not be considered as business-related expenses for the purpose of availing ITC.

Divergent Views from Advance Rulings

To seek clarity on this issue, taxpayers have approached the Advance Ruling Authorities (AAR) for guidance and a definitive tax position. However, the rulings from different AARs have been divergent, further complicating the matter.

For instance, the AAR in Uttar Pradesh, in the case of Dwarikesh Sugar, held that ITC on CSR expenses is allowable. In contrast, the same AAR in the case of SHRIRAM PISTONS AND RINGS LIMITED held that ITC on CSR expenses is not allowed.

Additionally, the Kerala AAR, in the case of Polycab Wires (P.) Ltd., disallowed ITC on CSR activities, treating them as gifts. Similarly, the Gujarat AAR, in the case of Adama India (P.) Ltd., held that CSR activities are not considered part of the normal course of business and thus the respective ITC is ineligible.

These contrasting rulings by different AARs have further intensified the debate, leaving businesses uncertain about the eligibility of claiming ITC on CSR expenditure.

Impact of Recent Amendment in the Finance Act 2023

The ongoing debate surrounding the eligibility of claiming Input Tax Credit (ITC) on Corporate Social Responsibility (CSR) expenditure under the GST regime took a significant turn with the introduction of a new amendment in the Finance Act 2023.

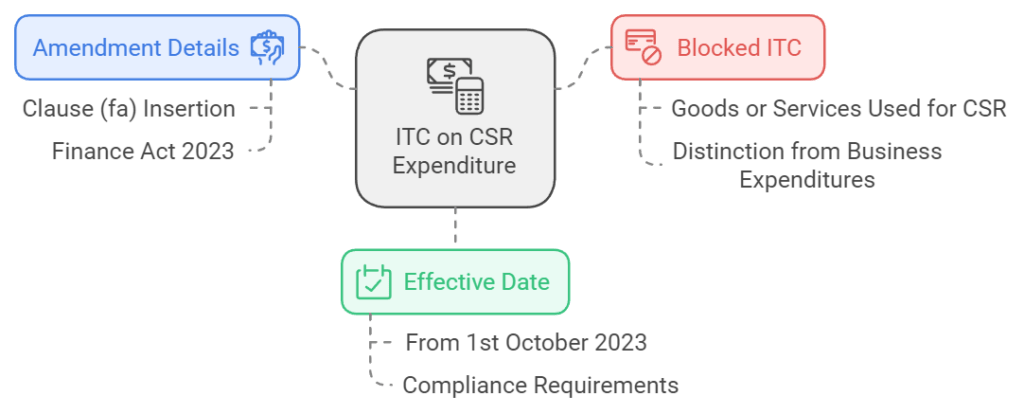

Insertion of clause (fa) in Section 17(5) under CGST Act

The amendment, introduced in the Finance Act 2023, inserted a new clause (fa) in Section 17(5) of the Central Goods and Services Tax (CGST) Act. This amendment directly addresses the issue of ITC on CSR activities.

According to the newly inserted provision in Section 17(5)(fa), ITC is specifically blocked for goods or services received by a taxable person, which are used or intended to be used for activities relating to their obligations under Corporate Social Responsibility as referred to in Section 135 of the Companies Act, 2013.

Blocked ITC on CSR activities

With the insertion of this new clause, the government has explicitly stated that ITC on goods or services used for CSR activities will be ineligible. This amendment aims to provide clarity on the matter and establish a consistent standpoint regarding the availability of ITC on CSR expenditure.

The blocked ITC for CSR activities reinforces the view that CSR expenses are distinct from regular business expenditures and should not be considered eligible for claiming tax credits.

Effective Date of Amendment

As with any new provision, it is crucial to determine the effective date of the amendment to understand its applicability. In this regard, the Central Board of Direct Taxes (CBDT) issued a notification specifying that the amendment proposed in the Finance Act 2023, which includes the insertion of clause (fa) in Section 17(5) of the CGST Act, shall come into force from 1st October 2023.

This effective date implies that businesses will need to comply with the new provision and refrain from claiming ITC on CSR expenditures from 1st October 2023 onwards.

Unresolved Questions and Pending Debatable Issues

While the recent amendment has provided some clarity on the eligibility of claiming Input Tax Credit (ITC) on Corporate Social Responsibility (CSR) expenditure, there are still several unanswered questions and pending debatable issues regarding this matter. Let’s explore some of them:

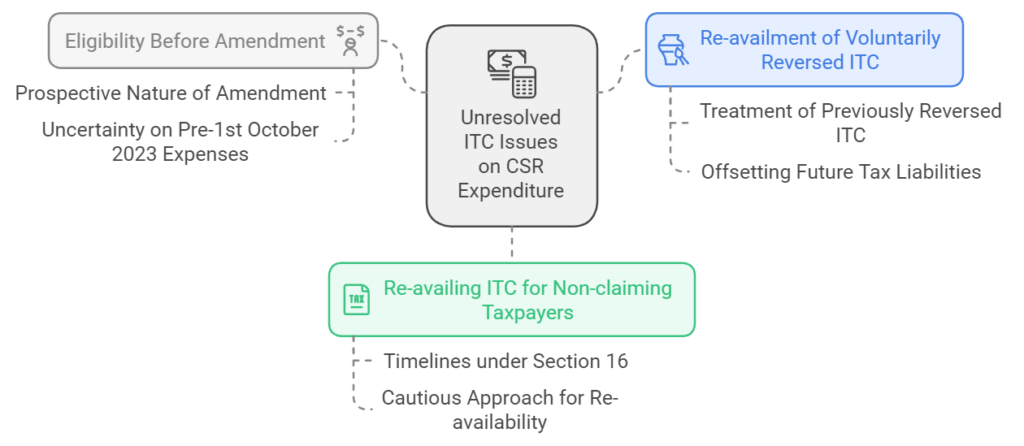

1. Eligibility of ITC on CSR expenses before the effective date of the amendment

One unresolved question is whether companies can claim ITC on CSR expenses incurred prior to the date of notification of the amendment, i.e., before 1st October 2023. As the amendment is prospective in nature, it creates uncertainty regarding the eligibility of ITC on CSR expenditures made prior to the implementation of the new provision.

2. Re-availment of voluntarily reversed ITC on CSR activities

Another question that remains unanswered is whether taxpayers who voluntarily reversed ITC on CSR activities, either due to ambiguity or caution, can re-avail the ITC once the amendment is in effect. This aspect raises concerns about the treatment of previously reversed ITC and whether it can be reclaimed to offset future tax liabilities.

3. Re-availing ITC on CSR activities for non-claiming taxpayers

Companies that had not availed ITC on CSR activities in the past due to varying interpretations of the law may now consider re-availing the credit. However, the re-availability of ITC for non-claiming taxpayers must be approached cautiously, considering the timelines prescribed under Section 16 of the CGST Act.

Conclusion: The Need for Clarity and Circular

The ongoing debate and the recent amendment in the Finance Act 2023 have brought both clarity and new questions to the forefront. To avoid unnecessary litigation and provide a comprehensive understanding of the eligibility of ITC on CSR expenditures, it is vital for the government to issue a detailed circular addressing these unresolved issues.

A proper circular would provide clear guidelines on the eligibility of ITC on CSR expenses incurred before the effective date of the amendment, the re-availing of voluntarily reversed ITC, and the timeline for non-claiming taxpayers to reclaim the credit. This will help businesses make informed decisions and ensure compliance with GST regulations.

In the absence of such a circular, there is a high likelihood of disputes and differing interpretations, leading to unnecessary litigation and delays in resolving this matter conclusively.

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.