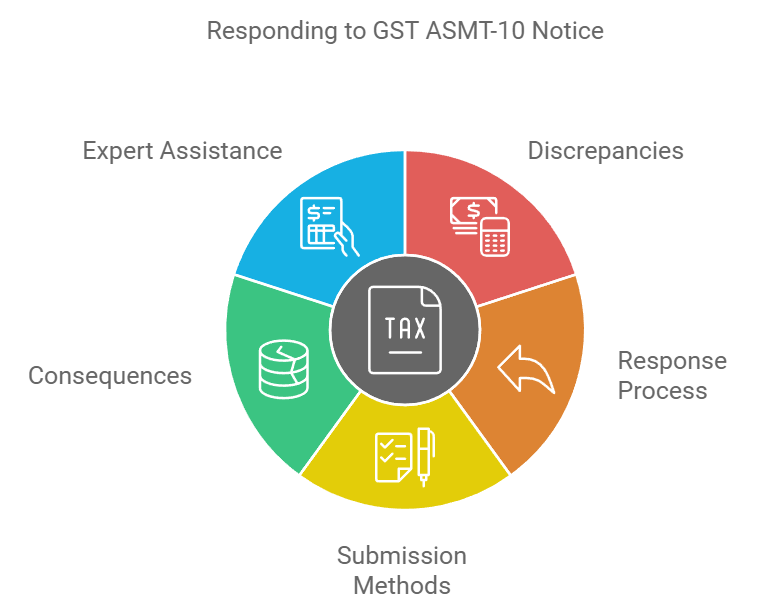

GST ASMT-10 Notice: How to Reply

This article provides an overview of the process and requirements for replying to a GST ASMT-10 notice.

Under the CGST Act, taxpayers may receive these notices to inform them of discrepancies in their GST returns. Common discrepancies include variations in tax liability reported, ITC claimed, and tax liability as per E-Way Bill.

Taxpayers are expected to respond within 30 days through a GST ASMT-11 form, either accepting the discrepancies and paying the specified amount or providing explanations and workings to the Proper Officer.

The reply can be submitted online via the GST portal using EVC or DSC.

It is crucial for taxpayers not to disregard these notices as they can result in potential audits, inspections, and tax liabilities. Seeking expert GST assistance may be beneficial to navigate the process effectively.

What is GST ASMT-10?

The GST ASMT-10 notice, issued under Section 61 of the CGST Act, 2017, serves as a means to inform taxpayers about discrepancies in their GST returns, requiring them to provide a reply within 30 days through GST ASMT-11, either accepting the discrepancies and paying the specified amount or offering explanations and workings to the Proper Officer.

This notice is crucial as it highlights the need for taxpayers to review and rectify any discrepancies in their GST returns. Failure to respond within the specified timeframe can result in adverse consequences, including additional tax liabilities and potential legal action.

The discrepancies that can lead to the issuance of GST ASMT-10 notices include differences in tax liability reported, Input Tax Credit (ITC) claimed, and tax liability as per the E-Way Bill. It is important for taxpayers to carefully analyze their GST returns and ensure accuracy in order to avoid receiving such notices.

Taxpayers are provided with the option to accept the discrepancies mentioned in the notice and pay the specified amount. Alternatively, they can provide explanations and workings to the Proper Officer, justifying the differences in their GST returns. It is advised to provide comprehensive and well-supported explanations to increase the chances of a favorable outcome.

The reply to the GST ASMT-10 notice can be filed online through the GST portal using Electronic Verification Code (EVC) or Digital Signature Certificate (DSC). It is crucial for taxpayers to adhere to the deadline and submit their reply within the stipulated timeframe.

If the Proper Officer is satisfied with the taxpayer’s response, the proceedings will be dropped with an order issued under GST ASMT-12. However, if the reply is not satisfactory, the Proper Officer may initiate further action under different sections of the CGST/SGST Act, including audits and inspections.

The GST ASMT-10 notice plays a significant role in highlighting discrepancies in GST returns and requires taxpayers to either accept and pay the specified amount or provide explanations and workings. It is crucial for taxpayers to respond within the given timeframe and provide well-supported explanations to avoid adverse consequences.

Common Discrepancies

Differences in reported tax liability, Input Tax Credit (ITC) claimed, and tax liability as per E-Way Bill are some of the common discrepancies that can lead to a scrutiny notice in the form of GST ASMT-10.

These discrepancies can arise due to various reasons such as errors in calculations, incorrect reporting, or mismatches in the information provided.

When a taxpayer receives a GST ASMT-10 notice, it is crucial to carefully analyze and identify the discrepancies mentioned in the notice. It is essential to review the tax liability reported in the GST returns, the ITC claimed, and the tax liability as per the E-Way Bill. Any inconsistencies or variations in these aspects can trigger a scrutiny notice.

To resolve these discrepancies, the taxpayer is required to file a reply within 30 days of the issuance of the notice. The reply should include explanations and workings to justify the reported tax liability, ITC claimed, and tax liability as per the E-Way Bill. Alternatively, the taxpayer can accept the discrepancies and pay the specified amount.

It is important for taxpayers to take these discrepancies seriously and respond to the notice promptly. Ignoring the ASMT-10 notice can result in further scrutiny, audits, and potential legal consequences. Therefore, it is advisable to seek professional guidance and provide a satisfactory reply to avoid unnecessary complications and ensure compliance with the GST regulations.

Filing Reply to ASMT-10

Taxpayers must promptly address the discrepancies outlined in the GST ASMT-10 notice by providing a detailed and well-supported response. This response, known as GST ASMT-11, must be filed within 30 days of receiving the notice. It is crucial for taxpayers to carefully analyze the discrepancies mentioned in the notice and gather all the necessary documents and information to support their response.

To make the filing process more structured and organized, taxpayers can use a table format to present their explanations and workings. The table can have three columns and four rows, with the first column containing the details of the discrepancy, the second column containing the taxpayer’s explanation, and the third column containing the supporting documents or evidence. This table format helps in presenting the information in a clear and concise manner, making it easier for the Proper Officer to understand the taxpayer’s response.

When filing the reply, taxpayers have the option to either accept the discrepancies mentioned in the notice and pay the specified amount or provide explanations and workings to justify their position. It is essential for taxpayers to provide a logical and well-reasoned response, addressing each discrepancy individually and providing any necessary calculations or evidence to support their claims.

It is important not to ignore the ASMT-10 notice as it can result in further scrutiny and potential legal consequences. By promptly addressing the discrepancies and filing a well-supported response, taxpayers can mitigate the risk of facing additional tax liabilities, audits, and inspections.

For Any Query

Consequences of Non-Compliance

Non-compliance with the prescribed procedures can lead to severe consequences for individuals and businesses. When a taxpayer receives a GST ASMT-10 notice and fails to file a reply within the stipulated 30-day period, it can result in adverse outcomes. Ignoring these notices can have significant implications, both in terms of time and resources, as well as potential tax liabilities.

If a taxpayer does not respond to the GST ASMT-10 notice, the Proper Officer may take appropriate action under different sections of the CGST/SGST Act. This can include conducting audits and inspections to assess the taxpayer’s compliance with GST regulations. Such actions can lead to additional scrutiny, further proceedings, and potential penalties for non-compliance.

It is important for taxpayers to take these notices seriously and provide a timely and satisfactory reply. Failure to do so can result in increased scrutiny and potential legal consequences. The consequences of non-compliance with GST ASMT-10 notices can be avoided by promptly addressing the discrepancies highlighted in the notice and providing explanations and workings to the satisfaction of the Proper Officer.

Non-compliance with the prescribed procedures outlined in the GST ASMT-10 notice can have severe consequences for individuals and businesses. It is crucial for taxpayers to respond to these notices within the specified timeframe and provide a satisfactory reply to avoid further scrutiny, legal action, and potential penalties.

Expert Assistance

Professional guidance and support can be instrumental in effectively addressing the concerns raised in the GST ASMT-10 notice and mitigating potential legal ramifications. When dealing with a GST ASMT-10 notice, seeking expert assistance can provide taxpayers with the necessary knowledge and expertise to navigate through the complex GST regulations and ensure compliance.

An expert in GST matters can provide valuable insights and advice on how to respond to the notice. They can help taxpayers understand the discrepancies identified in their GST returns and assist in preparing a comprehensive reply, including explanations and workings to justify the reported figures. Additionally, experts can guide taxpayers in understanding the legal provisions and implications associated with the discrepancies and the potential consequences of non-compliance.

By availing professional guidance, taxpayers can ensure that they respond appropriately to the GST ASMT-10 notice, reducing the risk of further legal complications. Experts can help taxpayers understand the intricacies of the GST regulations, provide accurate explanations, and devise effective strategies to mitigate risks. This proactive approach can save taxpayers time, effort, and potential tax liabilities.

Our Locations

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.

How to tackle asst-10 notice

you can contact us for any specific query using the contact page

Regards,

GOOD EVENING SIR,

I AM R MURALI, FROM TRICHIRAPALLI, TAMILNADU

AS PER ASMT 10 , WE GIVE REPLY THROUGH ASMT – 11 FOR THE FY 17-18, FOR THAT , AGAIN DEPT ISSUE US FINAL ORDER. IS IT CORRECT?

ASMT 10 REASONG NOT MISMATCH GSTR1 VS 3B AND GSTR2A/2B VS GSTR3B

PL GUIDE ME SIR,

WITH REG.

R.MURALI

9345325287

Mr. Murali,

Somebody from our office will contact you or you can send details to our email through contact page.