Guide to Director’s Remuneration in India: Limits, Conditions etc. (Section 197 & 198)

Understanding the intricate details of directors’ remuneration is crucial for ensuring compliance and fostering a transparent corporate environment.

The Companies Act, 2013, along with subsequent amendments, stipulates a comprehensive framework governing how directors are remunerated in India.

This guide aims to decipher these regulations to assist stakeholders in making informed, compliant decisions regarding director compensation.

Definition of Remuneration

In the realm of corporate governance, remuneration refers to the compensation provided to directors for their services to the company.

This compensation includes salaries, allowances, and other benefits as defined under the Income-tax Act, 1961.

However, not all forms of compensation are regarded as remuneration for calculating the limits set forth by the Companies Act.

Components Excluded from Remuneration:

As per Section IV of Schedule V of the Companies Act, 2013, certain perquisites are not considered part of the remuneration:

- Contributions to provident fund, superannuation fund, or annuity fund that are non-taxable under the Income-tax Act, 1961.

- Gratuity payable at a rate not exceeding half a month’s salary for each completed year of service.

- Leave encashment.

Furthermore, specific allowances for expatriate managerial personnel (including non-resident Indians) exclude:

- Children’s education allowance, capped at INR 12,000 per month for a maximum of two children.

- Holiday passage for children studying abroad or for family staying abroad. This includes one return passage per year in economy class or once every two years by first class.

- Leave travel concession for return passage for self and family according to company-specified rules.

Understanding these exclusions is pivotal, especially when complying with director remuneration policies, as miscalculations can lead to regulatory penalties.

General Conditions for Remuneration

The remuneration of directors in India is subject to the stipulations detailed in the Companies Act, which provides differing guidelines based on whether the entity is a Public or Private Company.

- Public Companies: The remuneration framework for directors in public companies is detailed in Section 197 of the Companies Act, 2013, read alongside Schedule V. Here, remuneration is determined by the company’s articles or a resolution passed at the general meeting—a special resolution if specified by the articles. More detailed explanations of these remuneration categories will follow in subsequent sections of this guide.

- Private Companies: Unlike public companies, private companies enjoy more flexibility as their director remuneration is largely determined by their Articles of Association, without the stringent ceilings applicable to public companies. This flexibility aids in simpler company management, especially for smaller firms or One-Person Companies.

For all companies, irrespective of their nature, adhering to these regulations ensures legality and contributes to the trustworthiness and reliability of the corporate environment.

Thus, understanding these guidelines is fundamental not only for compliance but also for maintaining the organization’s integrity.

For further information about director-related compliance in India, refer to Ahuja & Ahuja’s insights on company formation and director’s duties in India.

Detailed Remuneration Guidelines

The remuneration payable to directors can greatly vary depending on the financial health and type of company.

We give a closer look to specific regulations concerning public companies, divided into scenarios where the company has adequate profits and where it does not.

Public Company

Companies Having Adequate Profits

- Managing Director or Whole Time Director

- 5% of the net profits of the company may be allocated to one managing director or whole-time director.

- If there are more than one, collectively they can receive 10% of the net profits of the company.

- Other Directors (Non-managing/non-whole-time)

- Those that do not fall under the above categories, such as part-time directors, can receive up to 1% of net profits if there is a managing or whole-time director.They can receive up to 3% of net profits if there are no managing or whole-time directors. Note: The aggregate remuneration of all directors and managerial personnel can exceed specified limits with shareholder approval through a general meeting, especially crucial in scenarios where the company seeks top talent or needs to compensate for expertise.

Companies with Inadequate Profits or Losses

- Managerial Personnel

- Less than INR 5 Crores: Up to INR 60 Lakhs

- INR 5 Crores – INR 100 Crores: Up to INR 84 Lakhs

- INR 100 Crores – INR 250 Crores: Up to INR 120 Lakhs

- Above INR 250 Crores: INR 120 Lakhs + 0.01% of the effective capital exceeding INR 250 Crores

- Other Directors

- Similar scaling as above but with lower thresholds. Importantly, all payments exceeding these limits require special approval from shareholders, ensuring transparency and fairness.

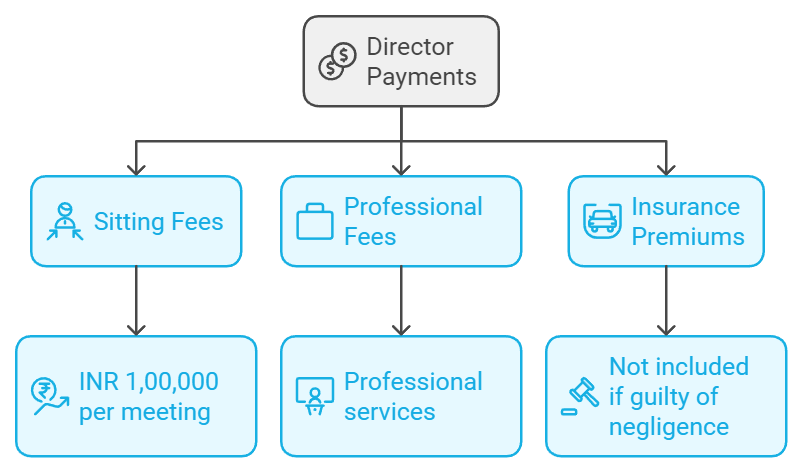

Additional Permissible Payments

Apart from their remuneration, directors in India may receive other types of payments legally without these being counted in the remuneration limits:

- Sitting Fees: Directors may be compensated for attending meetings of the Board or its committees, with fees not to exceed INR 1,00,000 per meeting. This ensures directors are motivated to contribute effectively during meetings.

- Professional Fees: Directors possessing specific professional skills may receive compensation for services rendered beyond their directorial duties, provided these services are of a professional nature.

- Insurance Premiums: Companies may purchase insurance for their directors against liabilities they might incur in their official capacities. The premium paid is not included as part of the remuneration unless the director is found guilty of negligence.

The transparency and legality of these payments are crucial for corporate governance and maintaining corporate ethics, ensuring directors are compensated fairly without jeopardizing the company’s financial health.

For specific regulations see our guide to director identification number.

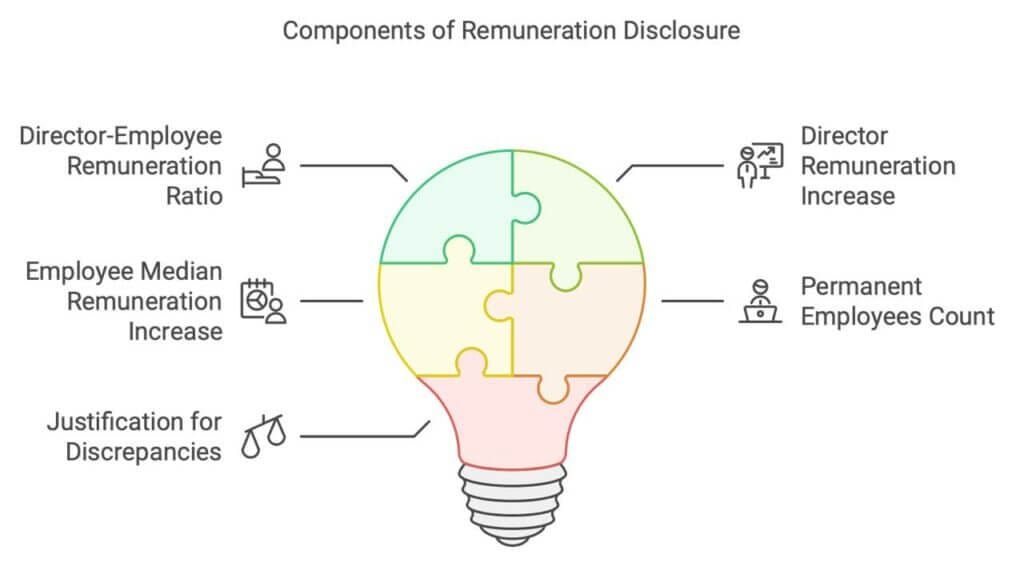

Reporting and Disclosures

Transparency in reporting and disclosure about directors’ remuneration is an essential aspect of corporate governance.

It ensures that all stakeholders, including shareholders, regulators, and the public, have access to clear and accurate information about the compensation practices of a company.

Disclosure in Board Report

- The ratio of the remuneration of each director to the median remuneration of the employees.

- The percentage increase in remuneration of each director, CFO, CEO, CS, or Manager, if any, within the financial year.

- The percentage increase in the median remuneration of employees in the financial year.

- The number of permanent employees on the rolls of the company.

- Justification for any significant discrepancies in the increase of remuneration and related assertions if managerial remuneration has significantly increased.

This disclosure helps in maintaining a fair remuneration policy and promotes accountability in corporate practices.

Audit Report

These disclosures are not just formalities but serve as a check to ensure that the remuneration policies adopted are equitable and justified, thereby cultivating trust among stakeholders and reinforcing the governance framework within the company.

Frequently Asked Questions (FAQs)

What should be the frequency of payment of remuneration?

Directors can be paid remuneration on a monthly basis as per the limits applicable for public companies and as per the articles of association of the company.

How is Net Profit computed for determining remuneration?

Net profit for the purpose of calculating managerial remuneration under the Companies Act is computed under Section 198. This computation considers various adjustments including income tax, depreciation, and other allowable deductions from the gross profits.

What are the consequences of non-compliance?

Directors who receive remuneration in excess of the stipulated limits or without necessary approvals must refund such excess amounts within a specified timeframe. Non-compliance may result in financial penalties ranging from INR 1,00,000 to INR 5,00,000, underlining the importance of adhering to legal standards.

Summary: Directors’ Remuneration in India as per Companies Act

Navigating the complexities of directors’ remuneration within the framework of the Companies Act, 2013 requires a thorough understanding and meticulous compliance.

By adhering to these guidelines, companies ensure equitable compensation practices that align with corporate governance standards and ethical business conduct.

This guide serves as a comprehensive resource in understanding and applying the regulations related to director’s remuneration in India, facilitating legal compliance and promoting transparent communication within corporate hierarchies.

For detailed steps on company registration in India, refer to authoritative sources that can provide up-to-date and relevant information.

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.