Direct Tax Vivad Se Vishwas (DTVSV) Scheme 2024 – A Comprehensive Guide

The Direct Tax Vivad se Vishwas (DTVSV) Scheme, 2024, established by Chapter IV (Section 88 to 99) of the Finance (No.2) Act, 2024, is a program implemented by the Indian government to settle pending income tax disputes. The primary objectives of the DTVSV Scheme are:

- To reduce the volume of pending income tax litigation.

- To generate timely revenue for the government.

- To benefit taxpayers by offering them:

- Peace of mind

- Certainty regarding their tax liabilities

- Savings in terms of time and resources that would otherwise be spent on protracted litigation

The DTVSV Scheme, 2024, came into effect on 1st October 2024. The scheme applies to a wide range of disputes, including those related to tax, interest, penalty, fees, or TDS/TCS, pending as of 22nd July 2024

The scheme outlines a structured process for settlement, including the use of specific forms for declaration, payment intimation, and final settlement order. The Central Board of Direct Taxes (CBDT) plays a crucial role in providing guidance to taxpayers and ensuring the smooth implementation of the scheme. The CBDT has issued a detailed circular and guidance notes to address frequently asked questions and clarify various aspects of the DTVSV Scheme, 2024.

The DTVSV Scheme offers taxpayers a valuable opportunity to resolve pending tax disputes efficiently and move towards financial certainty.

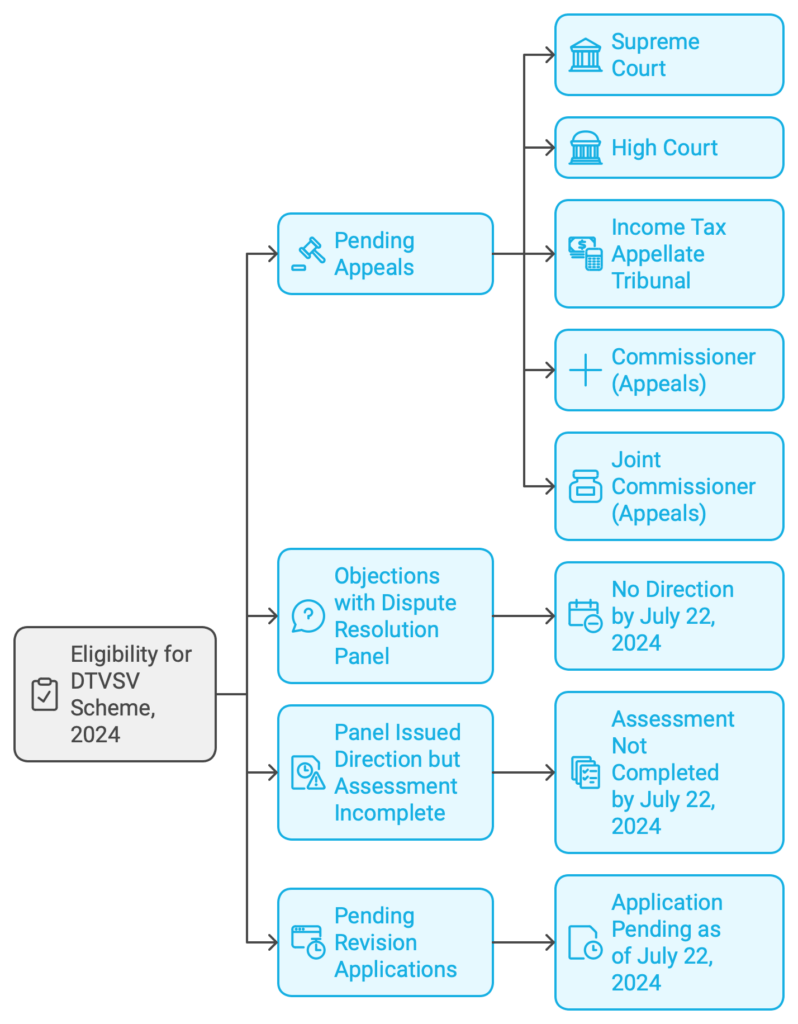

Who is eligible for using DTVSV Scheme, 2024

Here is a comprehensive list of who is eligible to use the Direct Tax Vivad Se Vishwas Scheme, 202:

- A Taxpayer with a pending appeal, writ petition, or special leave petition related to income tax that was filed by them, an income tax authority or both before July 22, 2024. An appellate forum could include the Supreme Court, High Court, Income Tax Appellate Tribunal, Commissioner (Appeals) or Joint Commissioner (Appeals).

- Someone who has filed objections with the Dispute Resolution Panel under section 144C of the Income-tax Act and the Dispute Resolution Panel did not issue any direction on or before July 22, 2024.

- Someone whose Dispute Resolution Panel issued a direction under subsection (5) of section 144C of the Income-tax Act, and the Assessing Officer had not completed the assessment under subsection (13) of that section on or before July 22, 2024.

- Someone who has filed an application for revision under section 264 of the Income-tax Act and the application was pending as of July 22, 2024.

The scheme only relates to income tax. Disputes related to other taxes such as wealth tax, security transaction tax, commodity transaction tax, and equalisation levy are not covered.

Ineligible Parties Under The DTVSV Scheme, 2024

- Taxpayers with assessments made under sections 143(3), 144, 147, 153A or 153C of the Income-tax Act based on searches initiated under sections 132 or 132A of the Act. This ineligibility particularly applies to assessments made under sections 153A or 153C, which are specifically framed based on searches conducted under sections 132 or 132A.

- Taxpayers with assessments framed under sections 143(3), 144 or 147 of the Income-tax Act that fall under the following categories:

- Where a search is initiated under section 132 or books of account, other documents or assets are requisitioned under section 132A on or after 1 April 2021, leading to subsequent assessments.

- Where the Assessing Officer, with the Principal Commissioner or Commissioner’s approval, determines that seized or requisitioned money, bullion, jewellery or other valuables under sections 132 or 132A on or after 1 April 2021 belong to the assessee, leading to subsequent assessments.

- Where the Assessing Officer, with the Principal Commissioner or Commissioner’s approval, determines that seized or requisitioned books of account or documents under sections 132 or 132A on or after 1 April 2021 pertain to the assessee or contain information related to the assessee, leading to subsequent assessments.

- Taxpayers with tax arrears related to an assessment year where prosecution has been instituted on or before the declaration filing date.

- Taxpayers with tax arrears related to undisclosed income or assets located outside India.

- Taxpayers with assessments or reassessments based on information received under agreements referred to in sections 90 or 90A of the Income-tax Act, if it relates to any tax arrears.

- Individuals subject to a detention order under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 (COFEPOSA), on or before the declaration filing date, provided the order meets specific conditions such as not being revoked or set aside by relevant authorities or courts.

- Individuals facing prosecution or convicted for offences under the Unlawful Activities (Prevention) Act, 1967, the Narcotic Drugs and Psychotropic Substances Act, 1985, the Prohibition of Benami Property Transactions Act, 1988, the Prevention of Corruption Act, 1988, or the Prevention of Money-Laundering Act, 2002.

- Individuals facing prosecution or convicted for offences initiated by an Income-tax authority under the Bharatiya Nyaya Sanhita, 2023, or for enforcing civil liability under any law, on or before the declaration filing date.

- Individuals notified under section 3 of the Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992, on or before the declaration filing date.

- Taxpayers with disputes related to wealth tax, security transaction tax, commodity transaction tax, and equalisation levy as the scheme only applies to income tax disputes.

- Taxpayers with interest disputes under sections 234A, 234B or 234C of the Income-tax Act who have filed waiver applications but do not have a pending appeal as of July 22, 2024. This is because filing a waiver application alone does not qualify someone as an “appellant” under the scheme’s definition.

- Taxpayers who received orders but did not file an appeal or special leave petition before the time limit expired on July 22, 2024.

- Taxpayers aiming to settle only a portion of their tax arrears, particularly those with disputes containing both qualifying and non-qualifying tax arrears. The scheme mandates settling the dispute in its entirety, including any non-qualifying tax arrears.

- Taxpayers intending to settle a penalty appeal while continuing to litigate the associated quantum appeal.The scheme requires settling both the disputed tax and the penalty levied on such disputed tax together.

- Taxpayers with disputes related to denied registration under section 12AA of the Income-tax Act.

- Taxpayers with set-aside matters that are pending as of July 22, 2024. Set-aside matters sent back to the Assessing Officer do not qualify as pending appeals under the scheme.

- Taxpayers who filed a writ petition against a notice issued under section 148/148A of the Act and have not received an assessment order following the notice. As the disputed tax is not ascertainable in these cases, they are ineligible.

- Taxpayers with Miscellaneous Applications (MAs) pending as of July 22, 2024. MAs are not considered appeals, and therefore there is no pending appeal in such situations.

- Taxpayers where the enforceability of an assessment order passed by the Assessing Officer has been stayed by the High Court or Supreme Court. A stayed assessment order does not equate to a pending appeal.

These exclusions aim to specify the scope of the DTVSV scheme and ensure its application to specific types of tax disputes.

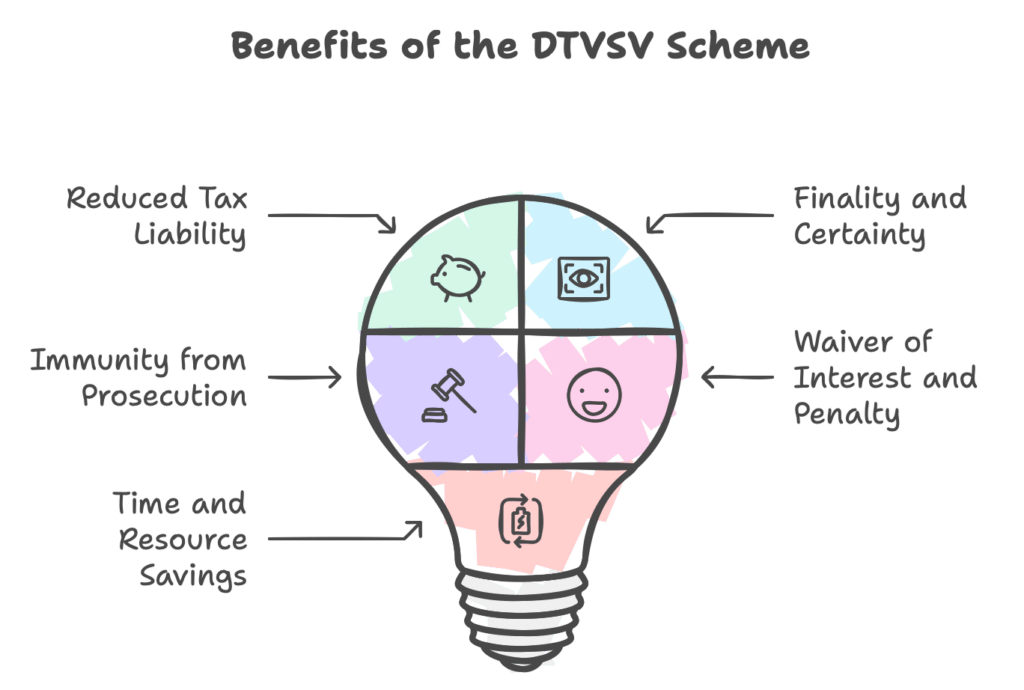

Advantages of the DTVSV Scheme, 2024

The Direct Tax Vivad Se Vishwas Scheme, 2024 (DTVSV Scheme, 2024), offers several advantages for eligible taxpayers, aiming to provide relief and encourage the resolution of tax disputes. Here are the key benefits:

- Reduced Tax Liability: The scheme allows taxpayers to settle their tax disputes by paying a reduced amount compared to the original tax demand. The specific percentage payable depends on factors such as the nature of the tax arrear, the date of filing the declaration, and the appellant’s status. This can result in substantial financial savings.

- Finality and Certainty: Upon payment of the determined amount, the designated authority issues a certificate of full and final settlement, concluding the dispute definitively. This provides taxpayers with certainty and peace of mind, as the matter cannot be reopened in any future proceedings.

- Immunity from Prosecution: The scheme grants immunity from prosecution for any offense related to the settled tax arrear. This protection extends to both the declarant and any associated directors or partners of the company or firm involved. This safeguards individuals from potential legal ramifications.

- Waiver of Interest and Penalty: When the disputed tax is settled, any associated interest and penalties are waived. This offers significant financial relief, especially in cases with prolonged litigation and accumulated interest.

- Time and Resource Savings: Engaging in litigation can be time-consuming and expensive. The scheme offers a streamlined process for dispute resolution, enabling taxpayers to save on legal fees and other associated costs.

Overall, the DTVSV Scheme, 2024, presents a valuable opportunity for eligible taxpayers to resolve their income tax disputes efficiently and cost-effectively. The benefits include reduced tax liability, immunity from prosecution, waiver of interest and penalties, and savings on time and resources. These advantages encourage voluntary settlement and contribute to reducing pending tax litigation.

Forms in the DTVSV Scheme, 2024

The Direct Tax Vivad Se Vishwas Scheme, 2024 (DTVSV Scheme, 2024) uses a series of forms to facilitate the declaration and resolution process for settling income tax disputes. Four distinct forms are specified for this purpose:

1. Form-1: Declaration and Undertaking by the Declarant

- This form is used by taxpayers (declarants) to express their intention to settle the tax dispute under the scheme and to provide an undertaking to withdraw any pending legal proceedings related to the dispute.

- Each distinct tax dispute requires a separate Form-1 filing.

- If both the taxpayer and the income tax authority have filed an appeal concerning the same order, a single Form-1 can be used.

- The declaration and undertaking in Form-1 must be verified by the taxpayer or an authorised representative, like someone permitted to verify the taxpayer’s income tax return.

2. Form-2: Certificate Issued by Designated Authority

- The Designated Authority, an officer of at least Commissioner of Income-tax rank, utilises Form-2 to issue a certificate to the taxpayer.

- This certificate determines the amount payable by the taxpayer under the scheme based on the declaration filed in Form-1.

- The Designated Authority has a timeframe of 15 days from receiving the declaration (Form-1) to issue Form-2.

- Once the order determining the payable amount is issued in Form-2, no appellate forum can proceed with deciding any issue related to the tax arrear.

3. Form-3: Intimation of Payment by the Declarant

- Taxpayers use Form-3 to inform the Designated Authority about the payment they have made, as determined in Form-2.

- Form-3 must be submitted along with proof of withdrawal of any related appeals, objections, applications, writ petitions, special leave petitions, or claims.

- The taxpayer has a window of 15 days from receiving the certificate (Form-2) to make the payment and submit Form-3.

4. Form-4: Order for Full and Final Settlement by Designated Authority

- Upon receiving Form-3 and verifying the payment, the Designated Authority issues an order in Form-4.

- Form-4 confirms the full and final settlement of the tax arrears by the taxpayer under the DTVSV Scheme, 2024.

The scheme emphasises that the order in Form-2, which determines the amount payable, is conclusive. The matters covered in this order cannot be reopened in any other proceedings, giving taxpayers finality in the settlement of their tax dispute.

Calculation of Amount Payable for Disputed Tax

The DTVSV Scheme, 2024, provides a framework for resolving income tax disputes, including those concerning disputed tax amounts. The scheme outlines a specific calculation method for determining the amount a taxpayer needs to pay to settle these disputes, taking into account factors such as the nature of the tax arrear, the date the taxpayer became an appellant, and the timing of the declaration filing.

Disputed Tax as Part of Tax Arrear

When the tax arrear comprises disputed tax, along with any chargeable or charged interest and leviable or levied penalty related to that disputed tax, the calculation of the payable amount differs from cases involving only disputed interest or penalty.

Key Factors in Calculation:

- Appellant Status:

- New Appellant: Filed appeal after 31 January 2020.

- Old Appellant: Filed appeal on or before 31 January 2020.

- Declaration Filing Date:

- On or before 31 December 2024: Benefits from a lower settlement amount.

- On or after 1 January 2025: Incurs a higher settlement amount.

Payable Amounts Based on Appellant Status and Declaration Date

The table below summarises the payable amounts based on the interplay of these factors:

| Appellant Type | Declaration Filing Date | Payable Amount |

| New Appellant (After 31/01/2020) | On or before 31/12/2024 | 100% of the disputed tax amount |

| New Appellant (After 31/01/2020) | On or after 01/01/2025 | 110% of the disputed tax amount |

| Old Appellant (On or before 31/01/2020) | On or before 31/12/2024 | 110% of the disputed tax amount |

| Old Appellant (On or before 31/01/2020) | On or after 01/01/2025 | 120% of the disputed tax amount |

Concessions and Special Circumstances

The scheme provides for certain concessions and considers special circumstances that may impact the final payable amount:

- Appeals Filed by Income Tax Authority: If the income tax authority initiated the appeal, the payable amount is reduced to 50% of the amount calculated as per the table above.

- Favorable Decisions in Prior Appeals: If the taxpayer has previously received favourable decisions on the same issue from higher appellate forums (ITAT or High Court) that have not been reversed by the Supreme Court, the payable amount is also reduced to 50% of the standard calculation.

Clarifications and Examples

Clarifications on specific scenarios to illustrate the application of the scheme’s rules:

- If an appeal is pending as of 22 July 2024, but disposed of before the taxpayer can file a declaration, the taxpayer is ineligible for the scheme.

- Taxpayers cannot choose to settle only a portion of a dispute. The entire dispute must be settled.

- A taxpayer cannot settle a penalty appeal while the associated quantum appeal is still under litigation. Both appeals must be settled together.

Implications for Taxpayers

The DTVSV Scheme, 2024, aims to provide a clear and predictable pathway for taxpayers to resolve tax disputes. By outlining specific calculation methods and considerations for disputed tax amounts, the scheme encourages early settlement and offers financial incentives for timely resolution.

Taxpayers should carefully assess their eligibility, understand the applicable calculation methods, and consider the potential benefits of utilising the scheme to achieve finality and potentially reduce their overall tax liability. Consultation with a tax professional can provide valuable guidance in navigating the complexities of the scheme and making informed decisions.

Calculation of Payable Amount for Disputed Interest or Penalty

The DTVSV Scheme, 2024, offers a mechanism for taxpayers to settle disputes related to income tax, including those pertaining to interest, penalties, and fees. The scheme outlines a specific method for determining the amount payable by a taxpayer seeking to resolve such disputes.

When the tax arrear solely relates to disputed interest, penalty, or fee, the payable amount is calculated as a percentage of the disputed amount. This percentage is determined based on two key factors:

- The date on which the taxpayer became an appellant: This distinguishes between ‘new appellants,’ those who filed their appeal after 31 January 2020, and ‘old appellants’ who filed on or before that date.

- The date of filing the declaration under the scheme: Declarations filed on or before 31 December 2024, benefit from a lower settlement amount compared to those filed after 1 January 2025.

Here’s a breakdown of the payable percentages based on these factors:

New Appellant (Appeal filed after 31/01/2020)

- Declaration filed on or before 31/12/2024: 25% of the disputed amount (interest, penalty, or fee).

- Declaration filed on or after 01/01/2025: 30% of the disputed amount.

Old Appellant (Appeal filed before 31/01/2020)

- Declaration filed on or before 31/12/2024: 30% of the disputed amount.

- Declaration filed on or after 01/01/2025: 35% of the disputed amount.

Key Considerations

- The rationale for categorising taxpayers into ‘old’ and ‘new’ appellants is to provide a second chance for settlement to those who did not utilise the Vivad Se Vishwas Scheme of 2020. Old appellants, having chosen not to settle previously, face slightly higher settlement percentages.

- This calculation method applies specifically to disputes where the tax arrear pertains solely to disputed interest, penalty, or fee. If the tax arrear includes disputed tax, the calculation differs.

Final Words on DTVSV Scheme, 2024

The DTVSV Scheme, 2024 presents a significant opportunity for taxpayers to resolve outstanding income tax disputes in a simplified and cost-effective manner. By offering waivers on penalties and interest, the scheme encourages taxpayers to settle long-standing dues, freeing up their financial resources and providing peace of mind. Furthermore, by reducing litigation costs, the scheme offers a path towards cleaning up balance sheets and achieving greater financial certainty.

Benefits for both Taxpayers and Tax Administration

The benefits of the scheme extend to the tax administration as well. The resolution of pending litigation frees up resources and allows the authorities to focus on more complex cases. This results in a more streamlined and efficient tax system for all stakeholders.

Key Features for a Smooth Process

Several features of the DTVSV Scheme contribute to its effectiveness. The availability of clear rules and forms, coupled with the option for electronic filing, simplifies the settlement process. Additionally, the CBDT’s proactive approach in issuing circulars and guidance notes, addressing frequently asked questions, ensures clarity and transparency for taxpayers seeking to avail themselves of the scheme’s benefits.

Expert Advice Recommended

While the scheme aims to simplify the settlement process, taxpayers are encouraged to seek expert advice from tax professionals to assess their specific situation and determine the optimal course of action. This is particularly crucial for cases involving high-pitched assessments, where opting for the scheme may not be the most advantageous route.

Overall, the DTVSV Scheme, 2024 is a welcome initiative by the Indian government, providing a second chance for taxpayers to settle disputes and achieve financial resolution. It represents a positive step towards fostering a more efficient and amicable tax environment in India.

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.