Procedure for Company Registration in India: A Detailed Step by Step Guide

In the vast and vibrant entrepreneurial landscape of India, establishing a Private Limited Company is perceived as a key stride forward. This legal entity brings with it a sense of credibility, space for growth, and wide recognition. However, many aspiring entrepreneurs find it challenging to navigate the complex maze of regulatory requirements for company formation in India. This article aims to demystify the procedure for Company Registration in India, making it comprehensible even for laymen.

Background

Before delving into the pathway for registration, let’s understand the types of companies one can register in India. There are several categories of companies such as Private Limited Companies, Public Limited Companies, and One Person Companies (OPC), each with its unique features and requirements. This review primarily focuses on the procedure for the registration of Private Limited Companies, a popular choice amongst startups and small businesses due to their limited liability and ease of access to funding.

A Private Limited Company draws its essence from its legal identity, distinct from its members. This nature equips the company with the ability to own assets, incur debts, and sue or be sued in its name. Registering a company is an essential step, offering considerable legal protection, potential for scalability, and enhancing customer trust. Moreover, registration paves the way for an effective regulatory framework, ensuring compliance and enhancing the company’s reputation.

Having established this context, let’s have a closer look at the prerequisites for launching a Private Limited Company in India.

Types of Companies in India

There are various company types and business structures in India. Here’s a detailed explanation of each:

Companies under the Companies Act, 2013

These companies are governed by the Companies Act of 2013 and offer features like limited liability and a separate legal entity, making them attractive for various business needs:

- Private Limited Company: Considered a popular choice for startups and small businesses, a Private Limited Company requires a minimum of two shareholders and limits the maximum to 200. One of the key advantages is that there are no restrictions on shareholder nationality, allowing both individuals and corporate entities, including foreign ones, to participate.

- Public Limited Company: In contrast to a Private Limited Company, a Public Limited Company has the ability to raise capital from the public by offering shares through a stock exchange. This makes it suitable for larger businesses looking to expand and access public funds.

- One Person Company (OPC): Designed specifically for solo entrepreneurs, an OPC allows a single individual to establish a company and hold all its shares. The sole shareholder in an OPC receives all profits but is also responsible for all losses. This structure provides the benefit of limited liability to the individual.

- Section 8 Company: This company type is unique in that it is established as a non-profit organization. A Section 8 Company aims to promote various social causes, including commerce, art, science, sports, education, research, social welfare, religion, charity, and environmental protection.

- Small Company: The Companies Act defines a Small Company as an entity with modest investment limits. Specifically, a Small Company cannot exceed a capital ceiling of Rs. 4 crores and its turnover should remain below Rs. 40 crores. This classification recognizes that businesses can achieve success and quality even without massive scale.

Other Business Structures in India

Apart from companies formed under the Companies Act, there are other structures that provide alternative frameworks for conducting business in India:

- Sole Proprietorship: This structure represents the simplest form of business, where a single individual owns and manages the entire operation. The key characteristic of a Sole Proprietorship is that there is no legal distinction between the business and its owner. This means the owner is personally liable for all business debts and obligations.

- Partnership Firm: When two or more individuals decide to pool their resources and expertise to run a business together, they can form a Partnership Firm. A Partnership Firm in India operates under the framework of the Indian Partnership Act, 1932, and is guided by a partnership deed that outlines the rights, responsibilities, and liabilities of each partner.

- Limited Liability Partnership (LLP): Combining aspects of both a company and a partnership, an LLP provides a flexible structure for businesses. A key advantage of an LLP is that it offers limited liability protection to its partners, similar to a company. This means the personal assets of the partners are shielded from business debts and liabilities.

The choice of business structure depends on factors such as the nature of the business, ownership preferences, desired liability protection, regulatory requirements, and tax implications.

Types of Private Limited Companies

The Companies Act has cataloged private companies based on shareholder count and investment limits. Let’s decode each one:

Private Limited Company:

Private Limited Companies under the Companies Act of 2013 have made quite a mark. They are characterized by a minimum of two shareholders with a cap at 200, thereby setting a clear boundary for ownership. Shareholders can be individuals or corporate entities, both Indian and Foreign. A unique aspect is the absence of nationality restriction, making it a melting pot ready to welcome diverse investors with open arms.

One Person Company (OPC):

An OPC is crafted for the entrepreneurs who dare to go solo. The Act permits only one individual to hold the entire shareholding. This single shareholder reaps all the profits while also bearing the losses.

Small Company:

A Small Company stands as the epitome of modest investment under the Companies Act with specific thresholds for capital and turnover. It’s like saying, “Big isn’t always better!” With a capital ceiling of Rs. 4 crores and turnover not to tip beyond Rs. 40 crores, it resonates with a David versus Goliath scenario, proving that size does not constrain quality or success.

With this understanding of the types of private companies, we can say that India offers a range of corporate structures to suit different needs and capacities. Each type has its benefits and can be chosen based on the scale, scope, and goals of the business you aim to operate.

Basic Requirements of a Private Limited Company in India

Venturing into the world of entrepreneurship with a Private Limited Company necessitates certain basic requirements, as highlighted in the Companies Act, 2013. Discerning these criteria is crucial for seamless company formation, whether in Noida, Gurgaon, or any part of India. For instance, registration in Noida or Gurgaon requires adherence to the same set of nationwide company norms.

Here are the prerequisites for establishing a Private Limited Company in India:

- Number of Members and Directors: A Private Limited Company should have at least two members (or shareholders) and maximum of 200. The minimum number of directors required is two, with at least one resident director who has stayed in India for a minimum of 182 days in the previous calendar year.

- Director Identification Number (DIN): All directors are required to possess a DIN, which is a unique identification number. Before the registration process begins, directors can apply for DIN through form DIR-3 on the Ministry of Corporate Affairs (MCA) website. Learn more about obtaining DIN here.

- Digital Signature Certificate (DSC): A Class 3 category DSC is needed by the authorized director to certify the online company registration application. You can find more information on the process of obtaining a DSC here.

- Name of the Company: The name should be relevant and reflective of your company’s business activity, ensuring it resonates with your customer base. It must comply with MCA guidelines, and it should be distinct from existing Company, LLP, or registered trademark names.

- Registered Office Address: The company must provide a registered office address in India, which will be the official correspondence address.

Having understood the foundation of a Private Limited Company, let’s walk through the step-by-step guide for Company Registration in India.

Step-by-step Procedure for Company Registration in India

Venturing into the corporate world by setting up your Private Limited Company in India involves a series of precise steps. Following this guide will ensure your journey towards registration is smooth and compliant with the legal framework.

Step 1: Acquire DIN & DSC of Promoters

The initiation of the company registration process begins with acquiring the Director Identification Number (DIN) and the Digital Signature Certificate (DSC) for the promoters or directors of the company.

- DIN is a unique identification number for a director and is necessary for filing the company registration application. The process for obtaining DIN is detailed elaborately on the MCA website.

- DSC is required to ensure the security and authenticity of the documents submitted electronically. As a digital equivalent of physical or paper certificates, a DSC validates and certifies the identity of the person filing the documents through the Ministry of Corporate Affairs portal. Make sure to apply for a Class 3 category DSC, which is used for company or LLP registrations.

Step 2: Select & Reserve Company Name

Choosing the right name for your company is crucial, as it reflects the identity and ethos of your business. The proposed name should be unique and not infringing on any pre-existing trademarks or company names. Here, the MCA’s SPICE Plus PART A form comes into play.

- File an application in SPICE Plus PART A form with up to two proposed company names. Each application costs a nominal government fee of Rs. 1000. After a thorough review, the ROC will reserve the valid and available name for your company.

Step 3: Draft MOA & AOA

The Memorandum of Association (MOA) and Articles of Association (AOA) are the charter and internal rules of your company, respectively. Drafting these documents meticulously is pivotal, as they define the company’s scope of work and the rules governing its internal management.

- MOA outlines the company’s objectives, whereas AOA sets the rules for its day-to-day operations.

Step 4: File SPICE Plus Application

After securing the name reservation, the next step involves filing the SPICE Plus Application (INC-32), which is an integrated application for company incorporation.

- This application can be completed and filed through the MCA’s portal. It encompasses several forms that cover the gamut from name reservation to DIN allocation, making the process streamlined and efficient.

Step 5: Get Company Registration Certificate

Upon successful submission and processing of the SPICE Plus application, along with all relevant documents and fees, the Registrar of Companies (ROC) examines the application. If everything is in order, the ROC registers the company, issuing a Certificate of Registration.

- This certificate is a conclusive proof of your company’s legal identity, containing the Corporate Identification Number (CIN). Additionally, the newly registered company is allotted its PAN and TAN at the same time.

This step-by-step guide is the ladder towards officially registering your company. Each step needs to be executed with care and due diligence, ensuring that all provided information is accurate and that you adhere to the legal requirements.

Documentation Required for Company Formation

Proper documentation is integral to the company registration process. Inadequate or incorrect documentation can lead to delays or rejection of the application. Here’s what you need:

Documents from Promoters

- PAN Card for Indian nationals, which serves as a primary ID proof.

- Passport, if a promoter is a foreign national.

- Address Proof: Recent utility bills (not older than 2 months), Aadhaar Card, Voter ID, or Passport.

- Passport-sized Photographs of all directors and shareholders.

Registered Office Documents

- Proof of Registered Office Address: Recent utility bill or lease/rent agreement and a no-objection certificate from the landlord.

Legal Drafts & Forms

- Memorandum of Association (MOA) and Articles of Association (AOA): These are the core legal documents forming the company’s constitution.

- DIR-2: Consents from the directors.

- INC-9: Declaration by the first subscriber(s) and director(s).

- INC-14: A declaration from a professional certifying that all compliances have been made.

Much of the process has been simplified with the introduction of the SPICE Plus form (INC-32), which consolidates several forms into one, reducing the paperwork necessary for company registration.

Time Taken for Company Incorporation Process in India

The duration of the company registration process in India varies, typically taking around 10 to 15 working days from the date of filing the application, assuming there are no discrepancies or issues with the submitted forms or documents. This timeframe is an approximation and can change based on:

- The workload of the Registrar of Companies (RoC).

- The completeness and correctness of the submitted application.

- Time taken for obtaining required clearances or responses.

Overall Cost of Pvt Ltd Company Registration

The cost of registering a Private Limited Company in India includes several components:

- Government Fees: Costs associated with name reservation and registration vary. Name approval fee is Rs. 1,000. Registration fees depend on the company’s authorized capital.

- Professional Fees: Charged by consultants or legal professionals helping with the registration process.

- Stamp Duty: Varies from state to state and is based on the authorized capital.

- Cost of Acquiring Digital Signatures and DIN: There are fixed fees for DSC and DIN applications.

Benefits of Company Registration in India

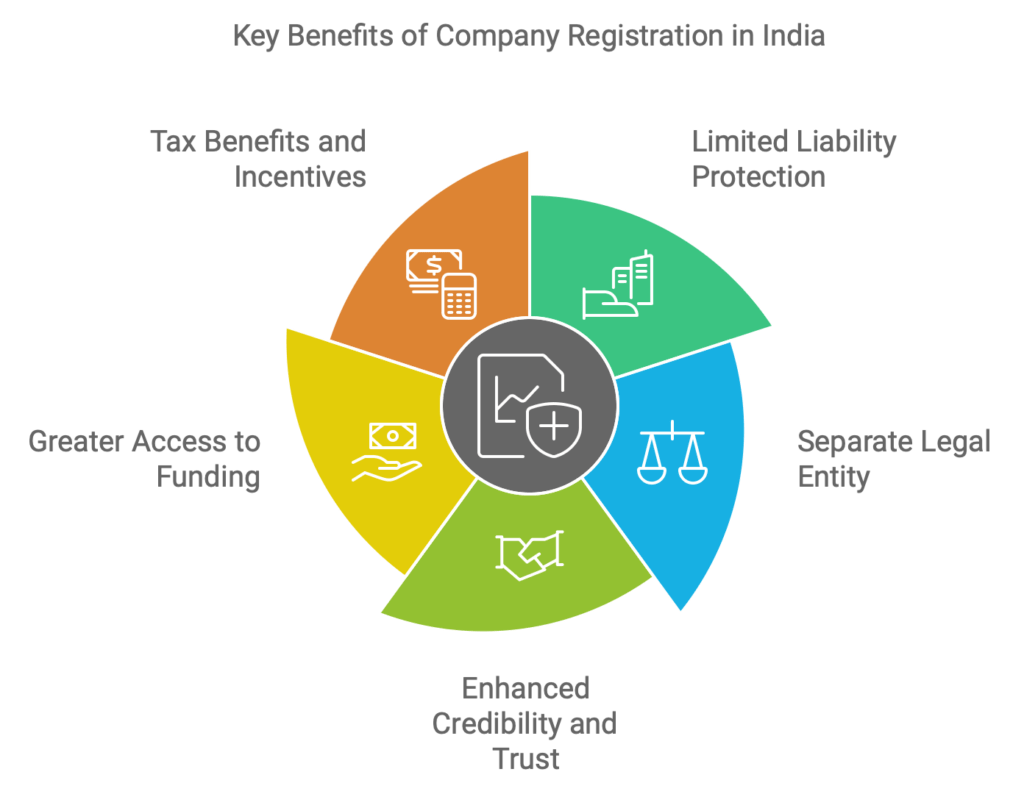

Registering a company in India offers numerous advantages, making it a desirable destination for entrepreneurs and businesses. The following are several key benefits:

- Limited Liability Protection: This is a significant advantage of company registration, especially for Private Limited Companies and One Person Companies. It ensures that the liability of shareholders is restricted to the amount they invested in the company. This protection safeguards their personal assets from business debts and obligations, providing a safety net for entrepreneurs.

- Separate Legal Entity: A registered company gains a distinct legal identity, separate from its owners or shareholders. This separation allows the company to engage in contracts, acquire assets, and participate in legal proceedings under its own name. This characteristic is crucial for establishing a professional business presence and fosters a sense of trust among stakeholders.

- Enhanced Credibility and Trust: Registration enhances the credibility of a business in the eyes of customers, suppliers, and partners. Choosing to register demonstrates a commitment to operating within the legal framework and following regulatory standards, leading to increased trust and confidence in the business.

- Greater Access to Funding: Registered companies have a higher probability of securing funding from various sources. Banks and other financial institutions view registered entities as more reliable borrowers. Similarly, venture capitalists and angel investors are more inclined to invest in companies with the legal backing and transparency that registration provides.

- Tax Benefits and Incentives: The Indian government offers various tax benefits to registered companies to encourage entrepreneurship and business growth. These benefits can include tax deductions, exemptions, and specific incentives tailored to promote certain industries and activities. Additionally, the corporate tax rates for some businesses might be lower than personal income tax rates, offering a financial advantage.

In addition to these, registering a company in India offers a structured way to operate a business while enjoying legal protections and benefits that contribute to long-term success.

FAQs

Q1: What is the time required to complete the Pvt Ltd Company registration process?

It usually takes about 10 to 15 days, subject to the accuracy of documents submitted and the workload at the ROC.

Q2: What are the minimum requirements for a company registration process in India?

A minimum of two directors and two shareholders is required, with at least one director being a resident of India. Additionally, a unique company name and a registered office address within India are mandatory.

Q3: What are the stages of the company registration process?

The stages include obtaining DIN and DSC for directors, reserving the company name, drafting MOA & AOA, filing the SPICE Plus application, and finally, receiving the Certificate of Registration.

Q4: Is there a minimum capital requirement for Pvt Ltd Company?

No, there is no minimum capital requirement to start a Private Limited Company. However, the contributed capital must be adequate for the company’s operational needs.

Q5: Is the company registration process mandatory in India?

Yes, as per the Companies Act, 2013, all private limited companies must be registered to operate legally in India.

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.