CARO 2020 Applicability: Which Companies are Covered and Which are Exempt

The auditors of companies, in the eyes of the law, hold a pivotal role in ensuring transparency, good governance, and the protection of shareholders including the public ones. To this effect, the Ministry of Corporate Affairs established a reporting system known as the Companies (Auditor’s Report) Order or CARO. CARO, which was first introduced in 1988 as MAOCARO, has undergone significant evolution, with landmark revisions in 2003, 2004, and then in quick succession more recently in 2015, 2016 and 2020. These changes always aim to ensure that reporting keeps pace with the changing business environment.

CARO 2020: A Closer Look

Decades after its inception, the Companies Act, 2013 mandated the auditor’s report for the specified companies to include additional reports specifying details or disclosures on certain points – a provision as per section 143(11). This evolved into the most recent iteration of the Order – CARO 2020.

CARO 2020 stands shoulder-to-shoulder with the dynamic financial landscape of the era. Applicable from the financial year 2021-22, it brings with it an increased reporting responsibility compared to its predecessor CARO 2016. It houses a total of 21 clauses requiring companies to report on various aspects like Fixed Assets, Inventory, and compliance with various laws and provisions.

Moreover, the instated Annual Returns under CARO 2020 summon for more elaborate financial audits for businesses. This new mechanism necessitates auditors to dive deeper into the financial transactions of a company, therefore offering much greater transparency for stakeholders.

Yet, the application of CARO 2020 is not created equal for all business entities. Designated companies, depending on the nature, size, and industry, have different guidelines according to the order. Thus, it becomes essential for companies to finely and carefully examine these guidelines while Filing their Annual Returns.

In the subsequent parts of this article, we will shed light on the applicability of CARO 2020, draw comparisons with the previous order CARO 2016, analyze the potential impact on the businesses, and resolve some of the frequently asked questions. This will ensure that by the end, the reader would be aware of the up-to-date ROC Filings Due Dates and important checkpoints for navigating CARO 2020.

Applicability of CARO 2020

CARO 2020 has set clear guidelines regarding its applicability to different types of companies. It applies to all statutory audits commencing on or after April 1, 2021, corresponding to the financial year 2020-21.

The order is applicable to all companies that were covered by CARO 2016. This includes all types of companies, including foreign companies operating in India. However, there are certain exceptions to its applicability:

- One Person Company: CARO 2020 does not apply to one person companies.

- Small Companies: Small companies, which are defined as companies with a paid-up capital of less than or equal to Rs 4 crore and with a last reported turnover of less than or equal to Rs 40 crore, are exempt from CARO 2020.

- Banking Companies: The order does not apply to banking companies.

- Companies Registered for Charitable Purposes: CARO 2020 is not applicable to companies registered for charitable purposes.

- Insurance Companies: Insurance companies are also exempt from the requirements of CARO 2020.

Additionally, some private companies are exempt from the requirements of CARO 2020. The following criteria must be met for private companies to be exempt:

- Gross receipts or revenue (including revenue from discontinuing operations) should be less than or equal to Rs 10 crore in the financial year.

- Paid-up share capital plus reserves should be less than or equal to Rs 1 crore as on the balance sheet date.

- The company should not be a holding or subsidiary of a public company.

- Borrowings should be less than or equal to Rs 1 crore at any time during the financial year.

It is important for companies to review their classification and ensure compliance with the applicability criteria to determine if they need to comply with CARO 2020.

Comparative Analysis with CARO 2016

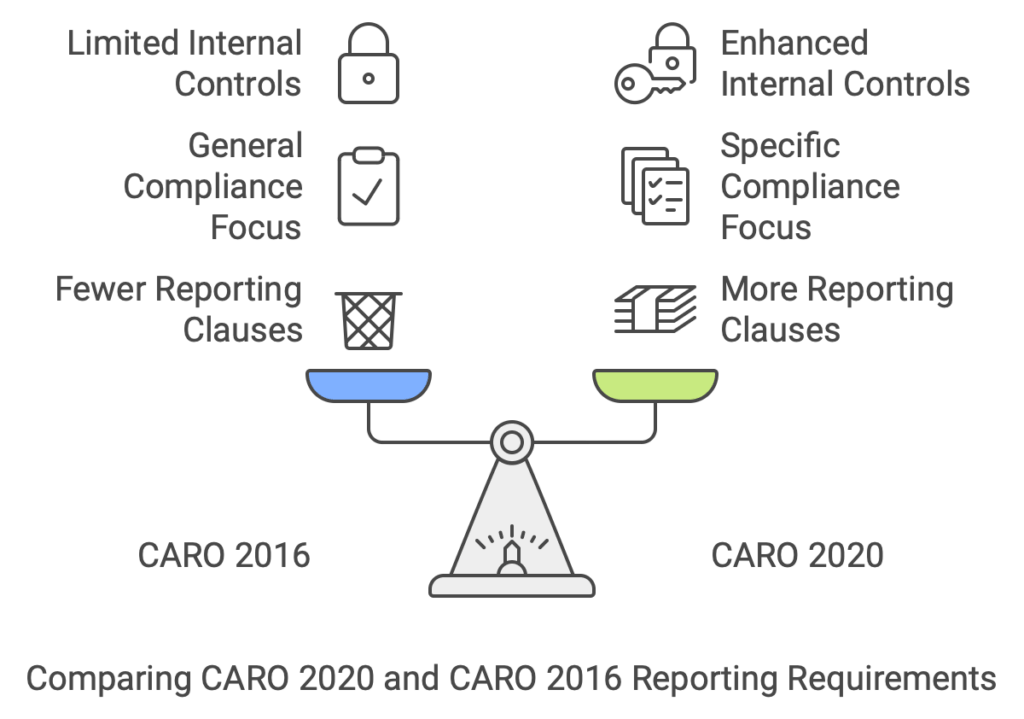

CARO 2020 brings significant changes compared to its predecessor, CARO 2016. It introduces additional reporting requirements, enhancing the level of transparency and disclosure. In this section, we will compare the key differences between CARO 2020 and CARO 2016:

- Increased Reporting Clauses: CARO 2020 consists of 21 clauses, while CARO 2016 had only 16. The additional clauses in CARO 2020 cover a wide range of areas, including fixed assets, inventory, loans and advances, compliance with taxes, and more. These additional reporting requirements provide greater insight into the financial health of the company.

- Specific Reporting on Regulatory Compliance: CARO 2020 places greater emphasis on reporting non-compliance with various laws and regulations. Auditors are now required to specifically report instances of non-compliance with tax laws, company law provisions, and other applicable regulations. This helps in improving the overall compliance culture within companies.

- Enhanced Reporting on Internal Financial Controls: CARO 2020 requires auditors to report on the adequacy and operating effectiveness of the company’s internal financial controls. This reporting provides assurance on the reliability of financial reporting and helps in identifying any weaknesses or gaps in the control environment.

- Expanding Scope of Reporting: CARO 2020 expands the scope of reporting by including additional areas such as loans granted, investments made, related party transactions, and utilization of funds raised through public issues or rights issues. This broader scope enables stakeholders to have a comprehensive view of the company’s financial activities.

- Disclosures on Fraud: CARO 2020 introduces the requirement for auditors to report on any instances of fraud involving employees or management that has a significant impact on the company. This reporting helps in detecting and preventing fraudulent activities within organizations.

It is essential for auditors and companies to familiarize themselves with the changes brought about by CARO 2020 and adapt their financial reporting processes accordingly. This will ensure compliance with the revised order and enable transparent reporting.

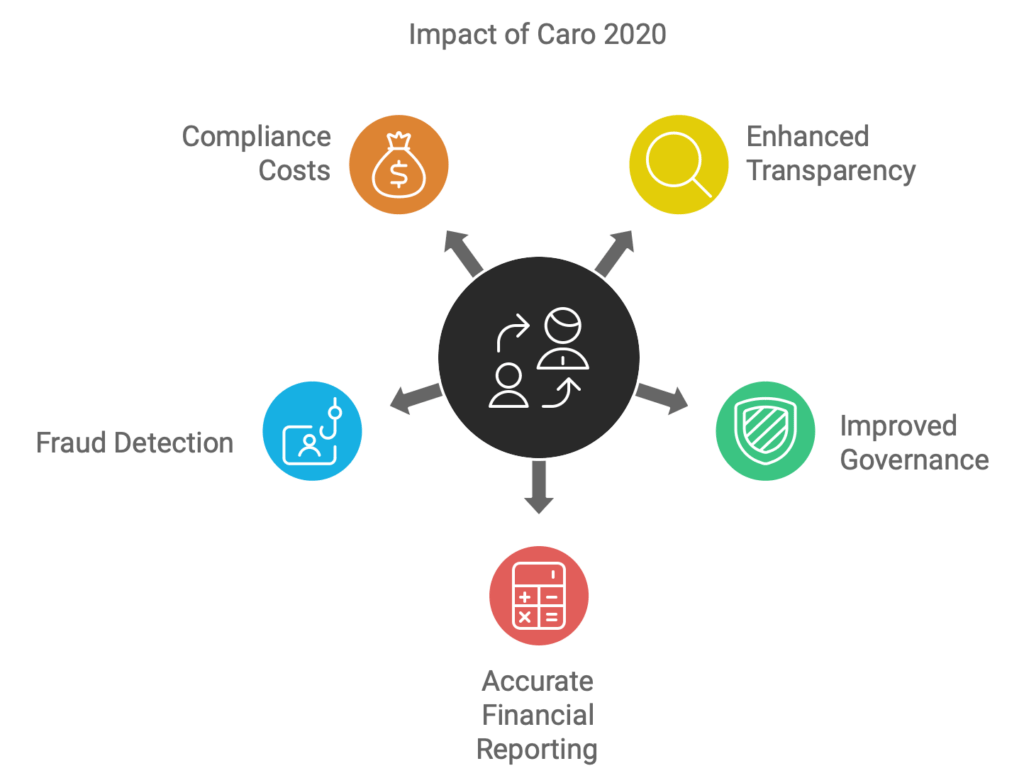

Impact of CARO 2020

CARO 2020 brings about significant changes in audit reporting, which consequently impacts businesses in various ways. Here, we discuss the potential impact of CARO 2020 and its significance for companies:

- Enhanced Transparency: With the additional reporting requirements of CARO 2020, stakeholders can gain a deeper understanding of a company’s financial position, operations, and compliance. This increased transparency fosters trust and confidence among shareholders, lenders, and other stakeholders.

- Improved Governance and Compliance: CARO 2020 places a greater focus on regulatory compliance, including adherence to tax laws, company law provisions, and other applicable regulations. By highlighting non-compliance, the order encourages companies to improve their governance practices and ensures adherence to relevant laws.

- Accurate Financial Reporting: The expanded reporting scope of CARO 2020, including disclosure of related party transactions, loans, and investments, provides a more comprehensive view of a company’s financial activities. This aids in more accurate financial reporting, enabling stakeholders to make better-informed decisions.

- Detection of Fraud and Irregularities: CARO 2020 mandates auditors to report on instances of fraud that significantly impact the company. This helps in detecting and addressing fraudulent activities within organizations, thereby promoting a culture of integrity and accountability.

- Impact on Compliance Costs: The revised reporting requirements of CARO 2020 may result in increased costs associated with audit and compliance activities. Companies may need to allocate additional resources to meet the enhanced reporting obligations, ensuring compliance with the order.

It is crucial for businesses to understand and comply with the requirements of CARO 2020. This includes robust internal controls, accurate record-keeping, and timely adherence to applicable laws and regulations. By doing so, companies can mitigate risks, maintain regulatory compliance, and build trust among stakeholders.

Frequently Asked Questions (FAQs)

Which companies are covered by CARO 2020?

CARO 2020 applies to all statutory audits commencing on or after April 1, 2021, corresponding to the financial year 2020-21. It is applicable to all companies that were covered by CARO 2016. This includes all types of companies, including foreign companies operating in India.

Are there any exemptions from CARO 2020?

Yes, there are certain exemptions from CARO 2020. These exemptions include one person companies, small companies (with specific criteria for paid-up capital and turnover), banking companies, companies registered for charitable purposes, and insurance companies. Additionally, some private companies are exempt based on criteria such as gross receipts, share capital plus reserves, and borrowings.

What are the major differences between CARO 2020 and CARO 2016?

CARO 2020 introduces additional reporting requirements compared to CARO 2016. It has 21 clauses, while CARO 2016 had 16. CARO 2020 places greater emphasis on reporting non-compliance with laws and regulations, reporting on internal financial controls, and disclosing instances of fraud. It also expands the scope of reporting to cover areas such as loans, investments, related party transactions, and fund utilization.

How does CARO 2020 impact businesses?

CARO 2020 enhances transparency, improves governance and compliance, ensures accurate financial reporting, and helps in detecting fraud and irregularities. It may lead to increased costs associated with audit and compliance activities. Overall, CARO 2020 promotes accountability, trust, and better-informed decision-making among stakeholders.

What steps should companies take to comply with CARO 2020?

Companies should review the applicability criteria of CARO 2020 to determine if they need to comply. They should understand the reporting requirements and ensure robust internal controls, accurate record-keeping, and timely adherence to relevant laws and regulations. Seeking professional guidance from auditors and consultants who specialize in statutory audit and compliance can also be beneficial.

Conclusion

In this comprehensive article, we have explored the applicability and significance of CARO 2020 under the Companies Act, 2013. CARO 2020, with its increased reporting responsibilities and expanded scope, aims to enhance transparency, improve governance, and ensure accurate financial reporting.

Compliance with CARO 2020 is essential for companies to fulfill their reporting obligations, maintain good governance practices, and build trust among stakeholders. Adapting to the revised reporting requirements and seeking professional guidance when needed will help companies navigate the complexities of CARO 2020 effectively.

As the business landscape continues to evolve, it is crucial for companies to remain aware, prepared, and responsive. Staying updated with the latest regulations and adopting best practices will enable companies to thrive in a dynamic and competitive environment.

We hope this article has provided you with valuable insights into CARO 2020 and its implications. Stay informed, stay compliant, and leverage the opportunities presented by evolving financial reporting standards.

If you have any further questions or require assistance with your accounting and financial needs, feel free to reach out to us for guidance and support.

Remember, compliance is not just a legal obligation but also a crucial element in building a strong and sustainable business.

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.