Abolishment of GST Rule 96(10) and its effects on Export Refunds

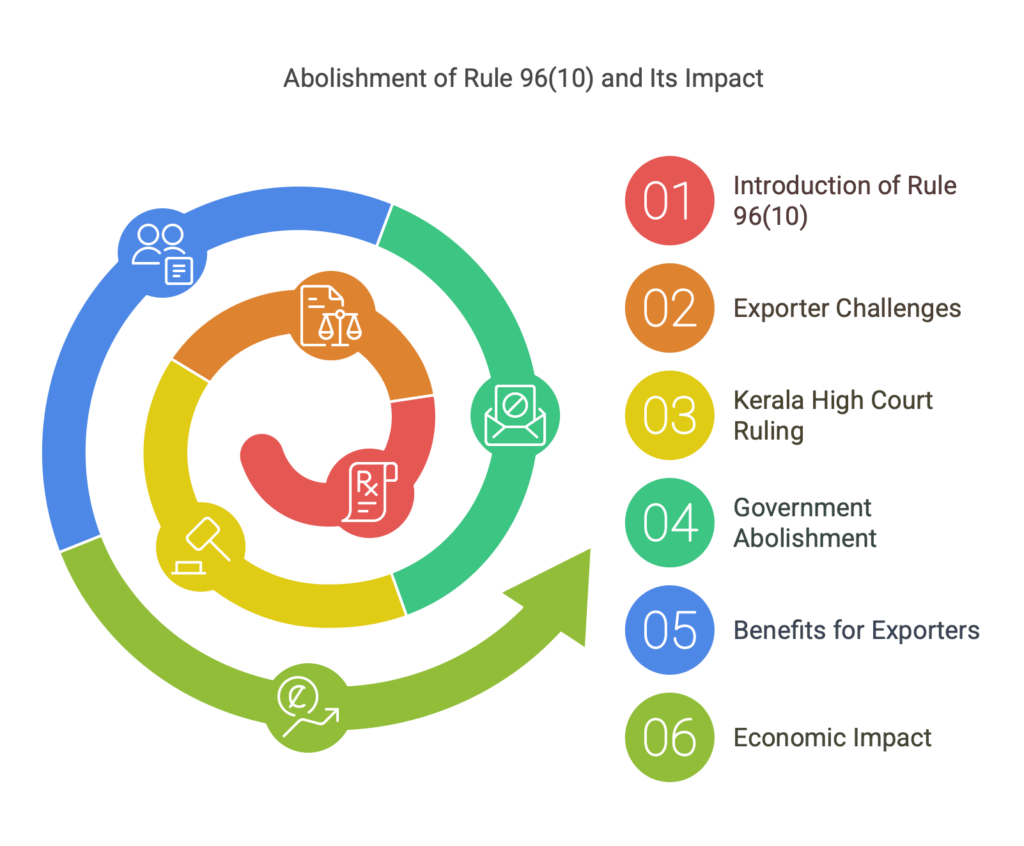

Rule 96(10) of the Central Goods and Services Tax (CGST) Rules, 2017, placed restrictions on exporters from claiming refunds on Integrated Goods and Services Tax (IGST) paid on exports. This rule applied if the exporters or their suppliers had availed certain benefits. The rule was intended to prevent exporters from using input tax credit (ITC) meant for domestic supplies to offset IGST for their exports, and to avoid double benefits where exporters claimed exemptions on inputs and also claimed a refund of IGST on exports.

Key Takeaways

- Rule 96(10) of the CGST Rules restricted exporters from claiming IGST refunds if they or their suppliers availed certain benefits.

- The rule was declared ultra vires (unconstitutional) by the Kerala High Court.

- The government abolished the rule through Notification No. 20/2024, simplifying refund procedures.

- The removal of Rule 96(10) reduces capital blockages and boosts export competitiveness.

- Exporters can now claim IGST refunds without previous limitations, enhancing the ease of doing business.

In response to these issues, exporters contested the validity of Rule 96(10) in various High Courts. The rule has since been omitted.

What was Rule 96(10) and How did it create problems for Exporters

Rule 96(10) of the Central Goods and Services Tax (CGST) Rules, 2017, placed restrictions on exporters from claiming refunds on Integrated Goods and Services Tax (IGST) paid on exports. This rule applied if the exporters or their suppliers had availed certain benefits. The rule was intended to prevent exporters from using input tax credit (ITC) meant for domestic supplies to offset IGST for their exports, and to avoid double benefits where exporters claimed exemptions on inputs and also claimed a refund of IGST on exports.

Here’s how Rule 96(10) created problems for exporters:

- Restrictions on refunds: Exporters were restricted from claiming refunds on IGST paid for exports if they or their suppliers had benefited from certain notifications, such as those related to Advance Authorization, Export Promotion Capital Goods Authorization, and exemptions for goods imported by Export Oriented Units (EOUs).

- Ambiguity in wording: The language of the rule suggested that even if only one supply of inputs benefited from the specified notifications, the exporter was restricted from seeking a refund on the IGST paid for their exported goods. This limited the exporter’s options and compelled them to export goods without paying IGST under a bond or letter of undertaking, even if only a portion of the supplies had received the benefits.

- Financial strain and procedural hurdles: This created significant challenges for exporters because it limited their ability to seek refunds for IGST paid on exports, even when a large portion of their inputs had not benefited from the notifications. This caused financial strain and procedural hurdles for exporters seeking rightful refunds.

- Legal actions and penalties: Tax departments initiated legal action, issuing summons and show-cause notices for alleged erroneous IGST refunds. This included levying interest not exceeding 24% and penalties equivalent to 15% of the tax under the CGST Act.

- Retrospective application: The retrospective application of the rule was validated by some courts, which had implications for exporters’ rights to refunds. This affected exporters who had legitimately expected and used their entitlement to refunds before the substitution of Rule 96(10).

- Disruption of business: The rule created uncertainty, disrupted the smooth functioning of export-oriented businesses, and potentially deterred foreign investment.

- Capital blockages: The rule also caused liquidity issues and capital blockages for exporters.

In response to these issues, exporters contested the validity of Rule 96(10) in various High Courts.

Legal Challenges to Rule 96(10) and Relief from Courts

The issues faced by the exporters was highlighted in various case laws, one of them being

“Rule 96(10) is manifestly arbitrary, lacks a reasonable basis, and is unfairly discriminatory. It is therefore declared ultra vires to Section 16 of the IGST Act.”

— Kerala High Court Ruling (Sance Laboratories Pvt. Ltd. v. UOI)

Sance Laboratories Pvt. Ltd. v. UOI & Ors. In this case, the Kerala High Court declared Rule 96(10) of the CGST Rules, 2017 “ultra vires,” or unconstitutional, to Section 16 of the Integrated Goods and Services Tax Act, 2017 (IGST Act).

The court found the rule to be “manifestly arbitrary”, meaning it lacked a reasonable basis and was unfairly discriminatory. This ruling was significant because it established that Rule 96(10) was invalid from its inception, paving the way for exporters to challenge its application and seek refunds of previously denied ITC.

Abolishment of Rule 96(10)

The ruling of Kerala High Court likely contributed to the government’s decision to ultimately abolish Rule 96(10) through Notification No. 20/2024 – Central Tax. The decision highlighted the issues with the rule, contributing to the government’s decision to remove the rule in order to streamline procedures and ensure that refunds on exports are no longer considered contraventions of earlier provisions.

Benefits of Abolishment of Rule 96(10)

The abolition of Rule 96(10) of the CGST Rules has brought significant benefits for exporters regarding their Integrated Goods and Services Tax (IGST) refunds and Input Tax Credit (ITC)

- Removal of Restrictions: The most significant benefit is the removal of restrictions that Rule 96(10) previously imposed on exporters. Before its omission, this rule restricted exporters from claiming IGST refunds if they or their suppliers had availed certain benefits on inputs. With the abolition of Rule 96(10), exporters can now claim IGST refunds without these limitations.

- Simplified Refund Process: The omission of Rule 96(10) has led to a simpler and more expedited procedure for refunds. The amendment ensures that refunds on exports are no longer considered contraventions of earlier provisions. This simplifies the process and removes a major hurdle that exporters previously faced, where even if a small portion of inputs received benefits, the exporter was restricted from seeking a refund.

- No Recovery of Past Refunds: The Central Government has stated that no recovery of refunds should be made for the period between 23rd October 2017 and 8th October 2024. This provides relief to exporters who were issued show cause notices, summons, and demand notices due to the retrospective application of Rule 96(10). This also addresses the issue of capital blockages that exporters were facing.

- Unlocking Blocked ITC: By removing the restrictions of Rule 96(10), exporters can now more easily convert their accumulated ITC into funds, thus removing any blockage on working capital. This is especially beneficial in cases where ITC accumulates due to capital goods procurement or the carryover of surplus credit.

- No more double benefit concerns: Rule 96(10) was implemented to prevent exporters from claiming a double benefit, receiving exemptions on inputs and also claiming a refund of IGST on exports. With the removal of the rule, it is implied that exporters can now claim both benefits concurrently without being penalized. This will reduce complexities and disputes for exporters.

Benefits to Indian Economy

The omission of Rule 96(10) through Notification No. 20/2024 – Central Tax dated 8th October 2024, has brought several benefits to the Indian economy, particularly for the export sector:

- Boost to Exports: By removing the restrictions and uncertainties surrounding IGST refunds, the notification has simplified and expedited the refund process for exporters. This encourages businesses to engage in export activities, leading to increased export volumes and revenue generation for the country.

- Improved Ease of Doing Business: The omission of the rule has streamlined procedures for exporters, making it easier for them to conduct business. This enhanced ease of doing business is likely to attract more foreign investment and promote economic growth.

- Enhanced Competitiveness: By simplifying the refund process, Indian exporters become more competitive in the global market. They can now focus on their core business operations without the added burden of navigating complex and potentially unfavorable regulations.

- Attraction of Foreign Investment: The removal of a contentious rule that was perceived as a deterrent to foreign investment is likely to improve investor confidence in the Indian economy. A stable and predictable regulatory environment encourages foreign investors to invest in India, leading to job creation and economic development.

- Positive Impact on Industrial Economy: The notification provides a significant relief to Indian industries, particularly those engaged in export activities. This relief helps businesses optimize their working capital and invest in expanding their operations, contributing to industrial growth and employment generation.

Final Words

? Final Words

The abolishment of Rule 96(10) marks a positive shift for exporters in India. It resolves IGST refund challenges, simplifies export procedures, and strengthens India’s position as a favorable destination for foreign investment.

The abolishment of Rule 96(10) marks a positive turning point for exporters in India. It not only resolves the immediate issues related to IGST refunds but also signals a commitment to creating a more conducive business environment for international trade. This move is expected to have a long-lasting impact on the Indian economy by promoting exports and enhancing the ease of doing business

Disclaimer

The materials provided herein are solely for educational and informational purposes. No attorney/professional-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for professional or legal advice.